5 x 1000 to Fondazione Comunica: a simple action with a deep meaning

- On 26 May 2016

You have to declared the 5 per mille on the tax return. But how to fill in the tax return? Here is some useful information for all taxpayers.

How to assign 5 x 1000?

It can be declared in 730, or in the Certificazione Unica or in modello unico persone fisiche.

If you choose the 730, you will find “Scelta per la destinazione del cinque per mille dell’irpef”, here you have to enter the social security number of those who will enjoy your funding, and then your signature.

Even in the Certificazione Unica you will have the exact same section with the same characteristics, only changes the color between the two models (orange for the 730, gray for the CU).

The modello unico persone fisiche presents a different scheme than previous models, because the patterns for the donation of 8 x 1000 and 5 x 1000 are on the same page. Anyway, on the section 5 x 1000 you will find the same information presents in 730 and CU.

5 x 1000: Why you should choose Fondazione Comunica?

5 x 1000 is not mandatory, however, this share of income will be captured automatically from the state, so it is always advisable to fill this section to help an organization that has an important charity in our society.

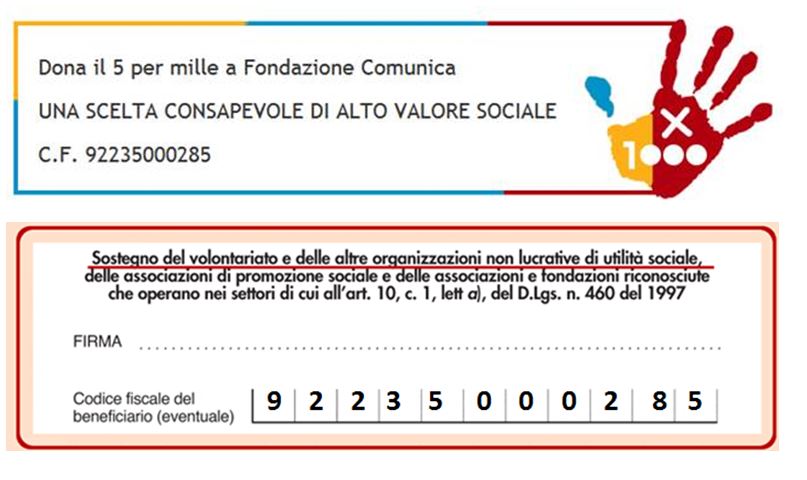

you can see on the image below the tax code you have to write in the relevant section.

If you will write the number 92235000285, you will help the culture of Communications, Innovation and Digital and support the Research and Training.

Thanks if you want to contribute to the development and growth of our activities!

0 Comments